reverse sales tax calculator texas

Input the Before Tax Price price without tax added on. Before-tax price sale tax rate and final or after-tax price.

Reverse Sales Tax Calculator 100 Free Calculators Io

Choose your county city from Texas below for local Sales Tax calculators.

. Vermont has a 6 general sales tax but an. Price Before Tax Final Price 1Sales Tax100 Tax Amount Final Price - Price Before Tax. The calculator will show you the total sales tax amount as well as the county city and special district tax rates in the selected location.

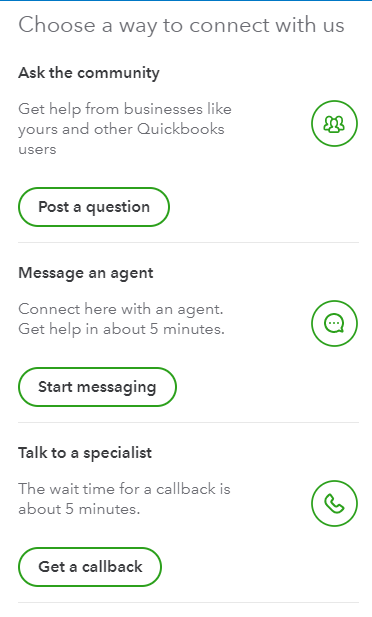

Input the Before Tax Price price without tax added on. And all states differ in their enforcement of sales tax. With QuickBooks sales tax rates are calculated automatically for each transaction saving you time so you can focus on your business.

To add tax to the price of an item multiply the cost by 1 the sales tax rate as a decimal. For example if the full payment is 5798 and you paid 107 sales tax you can enter these numbers into our calculator to determine your original pre-tax price. Current HST GST and PST rates table of 2022.

Sales Tax total value of sale x Sales Tax rate. Please check the value of Sales Tax in other sources to ensure that it is the correct value. Input the Tax Rate.

Input the Tax Rate. This script calculates the Before Tax Price and the Tax Value being charged. By using a good business calculator this mathematically tricky process will take much.

See also the Reverse Sales Tax Calculator Remove Tax on this page. Data and tax percentages from Texas are updated from httpscomptroller. Your sales tax would be 20000 times 6 percent which equals 1200.

We can not guarantee its accuracy. See also the Reverse Sales Tax Calculator Remove Tax on this page. Assume your sales tax rate is 6 percent and the purchase price of the car is 20000.

On March 23 2017 the Saskatchewan PST as raised from 5 to 6. Here is how the total is calculated before sales tax. Use the Sales Tax Calculator to calculate sales taxes on a pretax sale price or in reverse from a tax-included price.

The only thing to remember about claiming sales tax and tax forms is to save every receipt for every purchase you intend to claim. Following is the reverse sales tax formula on how to calculate reverse tax. We can not guarantee its accuracy.

Amount with sales tax 1 GST and QST rate combined100 or 114975 Amount without sales tax. This calculator allows you to select your loan type conventional FHA or VA or if you will pay cash for the property. Type here OR.

The Sales Tax Calculator can compute any one of the following given inputs for the remaining two. Sales tax rates can change over timethe calculator provides estimates based on current available rates. Please note that special sales tax laws max exist.

A reverse sales tax calculator is a computer-based method to calculate sales tax backward. Please check the value of Sales Tax in other sources to ensure that it is the correct value. This is especially important in case you want to figure the amount of Sales Tax you can claim when filing deductions.

Just enter the five-digit zip code of the location in which the transaction takes place and we will instantly calculate sales tax due to Texas local counties cities and special taxation districts. In Texas prescription medicine and food seeds are exempt from taxation. The sales tax rate ranges from 0 to 16 depending on the state and the type of good or service and all states differ in their enforcement of sales tax.

Tax rate for all canadian remain the same as in 2017. Instead of using the reverse sales tax calculator you can compute this manually. In Texas prescription medicine and food seeds are exempt from taxation.

Unless you have a dedicated point of sale system your business will need to calculate sales tax when a customer makes a purchase. If you want to know how much an item costs without the Sales Tax you might want to calculate reverse Sales Tax. Various sites provide this service to their users free of.

Texas has a 625 statewide sales tax rate but also has 981 local tax jurisdictions including cities towns counties and special districts that collect an average local sales tax of 1681. Thus you can compute the actual price and the sales tax charged on it out of a products post-tax priceThe formula for computing the actual sales price is easy. OP with sales tax OP tax rate in decimal form 1.

Or use Sales Tax calculator at the front page where you can fill in percentages by yourself. Check out flexible QuickBooks sales tax software for your business to track sales sales tax and cash flow. Why A Reverse Sales Tax Calculator is Useful.

Before Tax Price. See the article. Before Tax Price.

Amount without sales tax QST rate QST amount. For example if you paid 2675 for items and the tax on your receipt was. To find the original price of an item you need this formula.

Type here OR. When a customer returns an item youll need to calculate reverse sales tax for your records. There are times when you may want to find out the original price of the items youve purchased before tax.

In addition to that can localities impose their own taxes. The sales tax you pay is based on auto tax regulations in your municipality and is not typically influenced by whether the car is new or used. Calculate Reverse Sales Tax.

Business entities use reverse sales tax to understand the actual price of a product and the tax attributed to it. Rather than calculating sales tax from the purchase amount it is easier to reverse the sales tax and separate the sales tax from the total. A Reverse Sales Tax Calculator is useful if you itemize your deductions and claim overpaid local and out-of-state sales taxes on your taxes.

Here is the Sales Tax amount calculation formula. In Texas can a reverse mortgage be approved if. The base sales tax in Texas is 625.

Amount without sales tax GST rate GST amount.

Qb Online Has Changed It Sales Tax Processing It Does Not Work For Me Is Anyone Else Having Problems With New Sales Tax System

How To Calculate Sales Tax Backwards From Total

Sales Tax Calculator For Purchase Plus Tax Or Tax Included Price

How To Calculate Sales Tax In Excel Tutorial Youtube

Reverse Sales Tax Calculator 100 Free Calculators Io

Qb Online Has Changed It Sales Tax Processing It Does Not Work For Me Is Anyone Else Having Problems With New Sales Tax System

Welcome To Montgomery County Texas

Reverse Sales Tax Calculator Calculator Academy

Reverse Sales Tax Calculator Calculator Academy

Texas Sales Tax Calculator Reverse Sales Dremployee

Reverse Sales Tax Calculator Calculator Academy

Kentucky Sales Tax Calculator Reverse Sales Dremployee

How To Pay Sales Tax For Small Business 6 Step Guide Chart

Reverse Sales Tax Calculator De Calculator Accounting Portal

How To Calculate Sales Tax Methods Examples Video Lesson Transcript Study Com